Time extended for investigation and assessment

The tax authority must adhere to strict investigation and assessment periods. The periods that are now in force are:

- Normal 3-year period: the usual investigation and assessment period is basically 3 years, which starts to run from January 1st of the assessment year;

- Extraordinary 7-year period: if a case concerns (alleged) fraud, the term is extended to 7 years. If the tax authority wishes to conduct an investigation within this time, it must notify the taxpayer accurately and in advance in writing, informing him or her about the indications of (alleged) tax evasion;

- Extraordinary 5-year term (Art. 358 Income Tax Code 1992): in special circumstances, the tax authority has an exceptional period of 12 months or 24 months more to conduct an investigation and to make an assessment. This is possible especially if it concerns an international exchange of information or if the information has high probative value;

- Extraordinary 10-year term: if a case concerns a shell company or other corporate structures in a tax haven, the tax authority can even have a exceptional period of 10 years.

And this is where the change comes in. Depending on the situation, the tax authority could have a longer period of 4, 6, or 10 years:

- Normal 3-year period: if the declaration is filed on time but the tax authority wants to rectify it, it has 3 years to do so, which is the normal period;

- Extended term of 4 years: if the declaration is filed late or not filed at all, the tax authority will now have 4 years to make the assessment.

- Extended term of 6 years: if a case concerns an “international connection” and either the declaration is filed late or not filed at all, or the tax authority wants to rectify it, it will now have 6 years to investigate, assess, or rectify it. This applies to the following situations:

- If the taxpayer must file a local dossier or country report;

- If there is an obligation to report on payments exceeding EUR 100,000 made to tax havens;

- If there is an exemption, revocation, or reduction of withholding tax on moveable assets under a double-tax treaty, parent-subsidiary regulation, or interest-and-royalties regulation;

- If the taxpayer seeks the application of a Belgian Foreign Tax Credit;

- If the tax authority received information subsequent to an exchange of information relating to DAC6 (the 6th Directive on Administrative Cooperation) or online platform operations.

- Extended term of 10 years: if a case concerns (alleged) fraud, the tax authority will have 10 years from now on. This period will also apply to so-called “complex declarations”, namely (1) if there is a hybrid mismatch, (2) if CFC (controlled foreign corporation) rules apply, or (3) if there is an alleged shell company or other corporate structure.

Moreover, the special period under Art. 358 Income Tax Code 1992 remains valid.

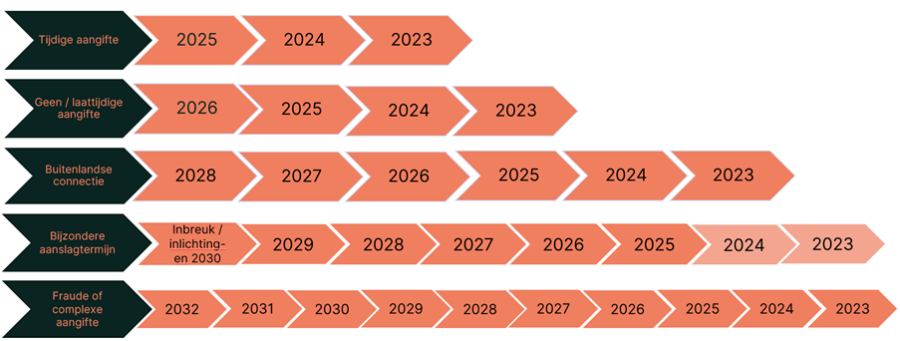

These new periods of time become effective from the assessment year 2023 and applies to wage withholding tax, VAT, withholding tax on moveable assets and real property. When we look at this as a time scheme, an investigation pertaining to assessment year 2023 can last until 2032:

Companies that are active internationally will thus be faced de facto with a longer investigation and assessment term of 6 years. Admittedly, the Explanatory Memorandum does specify that this longer term aims to have the “international element” (e.g., payments to tax havens) investigated, but other elements that come to light can also be taxed.

There are exceptions to certain elements, however. For example, the 6- or 10-year term cannot be applied to rectifications relating to certain rejected expenses, such as non-deductible automobile expenses, entertainment expenses, corporate hospitality gifts, dining expenses, employment benefits, …

Impact on the period for retaining accounting records and documents

Longer investigation and assessment periods have a direct impact on the taxpayer as well. They will have to ensure that they keep accounting records and documents for this extended period of 10 years (instead of the 7-year period, which applies now).

Opposition period extended

At this time, one has 6 months to file an opposition. This period will now by extended to 1 year.

Legal actions for fines

If a taxpayer does not cooperate in an investigation (e.g., by hindering a tax inspection visit, by not replying to a request for information), the tax authority can impose a fine on him or her from now on.

But this must be done by bringing the claim to court. Therefore, it is not the intention that the fine be imposed “in any event” and that judicial supervision be a formality. This would counter the fundamental rights of the taxpayer.

Other measures

Finally, the draft law provides for other miscellaneous procedural measures as well. These include:

- Extending the UBO register access to others;

- Qualifying undisclosed reserves as rejected expenses;

- Aligning the calculation of late payment interest and moratorium interest that are due on VAT and direct taxes. From now on, the calculation of these interest rates will be linked to the average interest rate of the linear bonds over a 10-year period in the months of July, August, and September of the previous year, which means that the interest rate due on VAT will be 4% higher than the rate due on direct taxes (thus 8% / 6% instead of 4% 2% for direct taxes).

What does this mean?

The possibilities for the tax authority to conduct an investigation and to make an assessment have been drastically expanded. For companies that are internationally active, a 6-year term will become the standard. Moreover, the tax authority will have new tools at its disposal from now on to deter a taxpayer’s refusal to cooperate in a tax investigation.

Any questions? Please contact Luk Cassimon (0472/467.847 or luk.cassimon@monardlaw.be) or Eline De Schepper (0474/798.207 or eline.deschepper@monardlaw.be) (or your usual point of contact at Monard Law).