1 PEPPOL is becoming compulsory in Belgium – action required

1.1 PEPPOL?

To enable invoices to be processed automatically, the supplier’s and the client’s IT systems need to speak the same language. That is why Europe has developed a framework known as Peppol that will considerably simplify the exchanging of invoices inside (and outside) the European Union. It makes use of a standard template for structured invoices, as defined in the European standard for electronic invoicing. These two elements complement one another perfectly and will make the large-scale use of e-invoicing possible.

From 1 January 2026 onwards, all companies in Belgium that are subject to VAT will be required to send and receive their B2B invoices via the PEPPOL network in Peppol-BIS format, in accordance with European standard EN 16931. At that point, conventional invoices in the form of PDF files sent by email will no longer suffice.

This legal obligation applies for:

- The supply of goods and services, which, for VAT purposes, is deemed to have taken place in Belgium.

- Non-exempted transactions (see Article 44 of the Belgian VAT Code, such as certain medical activities, for example).

1.2 What will this mean for your company, in specific terms?

- Registration: register your company in the PEPPOL network via a recognised Access Point.

- IT & administration: make sure that your invoicing software is compatible with PEPPOL. Contact your software supplier or accountant in good time in order to integrate PEPPOL-compatible software in your bookkeeping or ERP system.

- Internal processes: adapt your invoicing flow and internal verification.

- Contracts & general terms and conditions: update your company’s general terms and conditions (purchasing and/or sale conditions) and update your agreements so that they include a clause concerning e-invoicing via PEPPOL. When doing so, include a provision that invoices will only be valid if received or sent via PEPPOL and adjust your payment clauses and verification procedures accordingly. You should put in place a suitable arrangement governing any liabilities resulting from a failure to fulfil the Peppol requirements (or from a failure to do so correctly). Below, we have provided a brief summary of the risks you may be exposed to in such cases.

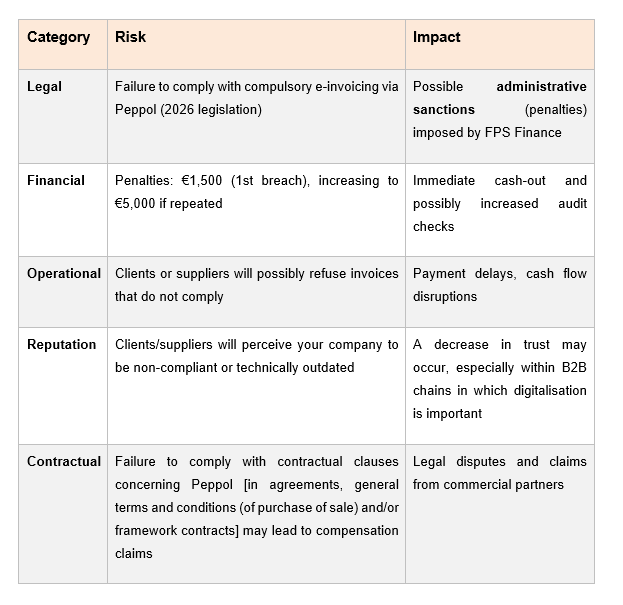

1.3 Risks with regard to a failure to fulfil the Peppol requirements (Belgium, B2B from 1 January 2026 onwards)

Important: In the regulations, the “receiving” of invoices is just as important as the “sending” of invoices. If your company cannot receive, that will also constitute a breach.

1.4 Why a PEPPOL clause is therefore definitely important

As outlined above, this new legal obligation concerning e-invoicing is not without consequences. The message is therefore to focus on compliance. Invest in clear and unequivocal clauses in your B2B agreements and general terms and conditions. That way, you will prevent any discussions regarding the validity of invoices. The limits and responsibilities of the contractual parties can also be set out, in the event that one of the parties does not fulfil its obligations (or does not do so correctly).

2 E-invoicing in the case of belgian government contracts

Since March 2024, e-invoicing has been compulsory for invoices arising from government contracts. Invoices for an amount less than €3,000 (excl. VAT) are exempt from this obligation but contracting parties are allowed to impose compulsory e-invoicing in the contract specifications. Stricter rules apply in the case of federal contracting parties: e-invoicing is compulsory at all times, even if the invoiced amount is less than €3,000.

This obligation arises from Directive 2014/55/EU, as transposed in the form of the Royal Decree of 9 March 2022 amending the Royal Decree on Awarding and the Royal Decree on Performance, amongst others.

2.1 What does this mean in specific terms in the case of government contracts?

For contractors:

- Invoices must be submitted electronically via Mercurius, the Belgian PEPPOL channel for government bodies.

- Only structured electronic invoices will be accepted. PDFs sent by email are not valid.

- Invoices that are not compliant will not be processed and will therefore not be paid.

For contracting parties:

Contracting parties must include explicit provisions in their contract documents concerning the compulsory use of PEPPOL. A clear stipulation in the specifications must include the following important items of information: the format (Peppol BIS Billing 3.0), the channel (Mercurius), the Peppol ID of the contracting party and references to be included on invoices.

The contracting party is therefore advised to draw the contractor’s attention to the fact that invoices not submitted via Peppol/Mercurius will be deemed unsubmitted.

3 The use of AI in companies: legal and economic points to consider

Artificial intelligence (AI) is longer a vision of the future, but a reality of everyday life in the business sector.

Artificial intelligence (AI) refers to technologies that are capable of performing tasks that require ordinary human intelligence, such as reasoning, learning, predicting or deciding. Examples of AI include tools such as ChatGPT that make use of large quantities of text data and are capable of generating responses, texts or even legal clauses independently.

Nowadays, AI has already been embedded in all manner of business processes: from customer service and marketing to legal documentation and product development, but its use is not without risks.

A recent example shows how the unregulated use of AI can result in serious consequences: during the admission examination for the study of medicine in Flanders, it was found that a number of candidates presumably made use of ChatGPT to answer questions. The (legal) uncertainty regarding the legal consequences of this did not pass by unnoticed.

This recent example illustrates how AI not only presents opportunities, but raises legal and ethical challenges as well.

An increasing number of companies are making use of AI tools as a means of automating processes, generating content, analysing customer data or even drawing up legal documents. Although this technology offers substantial gains in terms of efficiency, it also poses a number of new risks from a legal perspective.

For example, a newly created SME that used an AI tool to generate its general terms and conditions of sale for a new online store may possibly be in for an unpleasant surprise. Although the text produced by the AI tool appeared professional, it actually lacked essential provisions concerning consumers’ right of withdrawal. The result: the statutory withdrawal period never actually began and the SME was confronted with the problem of goods being returned late, which therefore had a significant effect on the company’s cash flow.

When integrating this new technology in your business processes, thinking critically is therefore as crucial as ever. It is important to:

- Communicate in a transparent waywith your contractual partners about the possible use of AI;

- Include contractual clausesthat set the parameters for the use of AI in the context of your specific business processes;

- Apportion liabilities in a balanced way, such as in the case of errors, data leaks or misleading output.

4 AI & government contracts

AI is also increasingly being used in the public sector, for purposes such as data processing, decision-making, document analysis or even legal support.

Initiatives such as AI4GOV and the AI4Belgium charter emphasise the importance of ethics, transparency and legal certainty whenever AI is used by government bodies.

Although no specific legislation governing the use of AI in government contracts yet exists in Belgium, AI applications are included within the existing scope of legislation such as:

- The Act of 17 June 2016 concerning government contracts.

- The Royal Decree of 18 April 2017 on the awarding of contracts;

- The Royal Decree of 14 January 2013 on the performance of contracts.

4.1 How can the use of AI be set out within contract documents?

To avoid legal uncertainty, contracting parties are recommended to include explicit provisions in their contract documents governing any use that is made of AI. This can be done in a variety of ways:

4.1.1 Technical specifications

- State whether AI tools can be used when performing the contract.

- Indicate which AI functionalities are permitted (e.g. generative AI, predictive models).

4.1.2 Award criteria

- Consider making use of a sub-award criterion concerning transparency regarding the use of AI and the ethical safeguards that the tenderer is required to provide.

4.1.3 Contractual clauses

- Oblige the contractor to report and document the use of AI.

- Specify the liability that applies in the event of erroneous output or a breach of regulations resulting from the use of AI.

4.2 The role of the tenderer

The use of AI also provides opportunities for the tenderer. If your company is a forerunner in its market and is therefore able to offer major efficiency gains by making use of AI, that could make for an economically attractive tender. As a potential tenderer, it is therefore beneficial to shine a spotlight on this and explain it in detail. Even if the contract documents lack an AI clause, it is advisable to focus on transparency in that regard.

5 Legal support with business acumen

The impact of PEPPOL and AI on your business extends beyond the technical side of things. It is important for you to be legally prepared as well:

- Update your general terms and conditions and ongoing contracts and/or modify your contract documents accordingly.

- Align internal processes and compliance with the new obligations.

- Think ahead: your position in public contracts (government contracts) will also be affected by this.

The clock is ticking: new obligations are about to be brought in during 2026 and will certainly have an impact on your business. The best approach is to put the items on your to-do list on your schedule for this autumn.

6 How we can help you

As lawyers specialising in commercial contracts and government contracts and with particular expertise in IT and the latest technology, we help companies and government bodies – in a pragmatic, hands-on way – to make these new risks manageable.

Would you like to learn more about the most effective way to get your organisation ready for the changes? If so, do not hesitate to contact us for an exploratory discussion.